connect with us

Want to get started with ThreadConnect? Reaching out with general questions? Find your form below.

legacy customers

Thread Bank is built on the foundation of Civis Bank — which has been serving Hawkins, Hancock, and surrounding counties since 1906. Our team is ready to serve you by phone, email, or in one of our local branches.

locations and hours

Thread Connect Logo

Thread Connect Logo

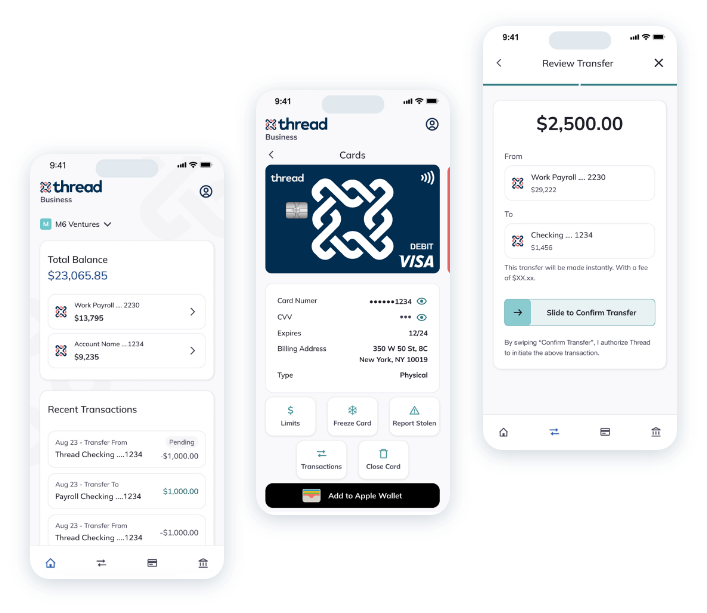

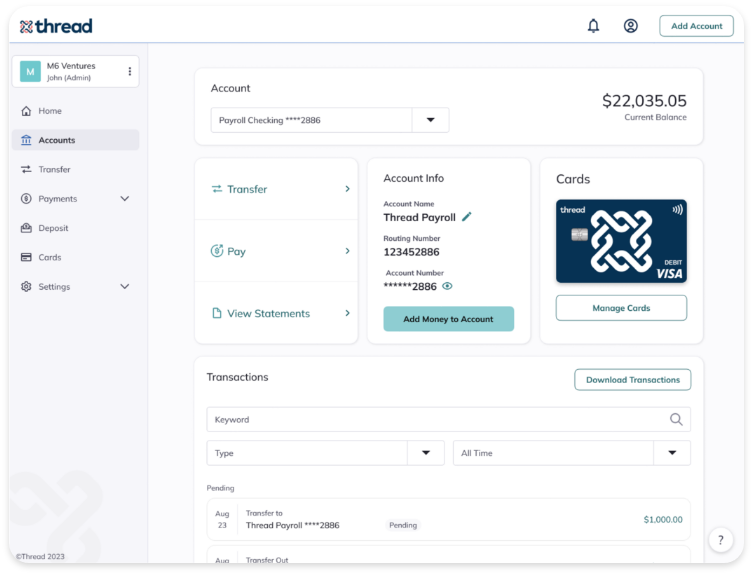

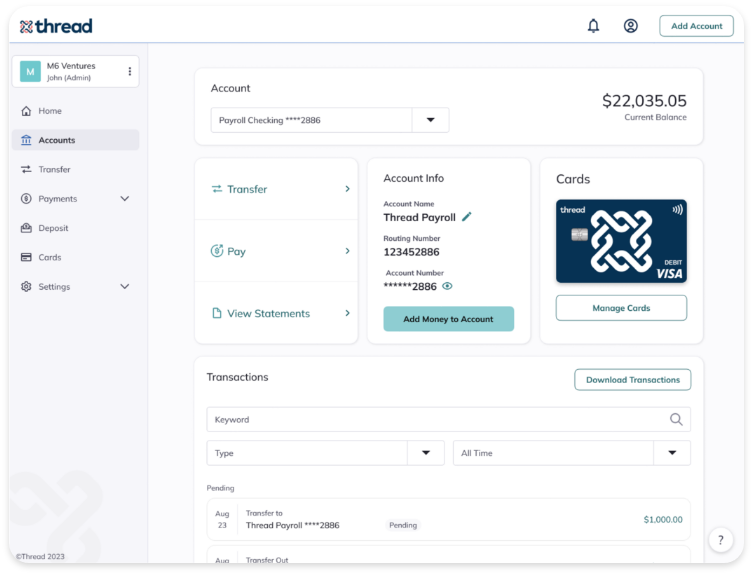

Our platforms seamlessly weave the digital and traditional banking experiences. We bring the convenience and innovation of modern banking to your fingertips.

connect with us

Thread Connect Logo

Thread Connect Logo

With ThreadConnect, you can elevate your business with innovative embedded financial services that support your growth and success.

connect with usdevelopers

Our embedded banking solution is built with developers in mind. We offer a robust suite of APIs and comprehensive documentation, making integration with your platform a breeze.

developer loginlogins

are you a branch customer?

For legacy customers of Civis Bank, please refer to the branch hours and locations listed to find the most convenient options for your banking needs.

Launch your branded debit or prepaid card program with ease. Our system simplifies creation and integrates seamlessly with payment networks, fostering deeper customer engagement.

connect with us

our history

-

our history

-

it all starts with

Our digital-first solutions combine best-in-class technology with a streamlined customer experience to reduce the time, effort, and mental energy of everyday business and personal banking.

-

we’ve funded

innovators since 1906Thread Bank was founded in Eastern Tennessee, which was a major launching point for Revolutionary War heroes heading West to claim their American dreams. That same pioneering spirit is driving the seasoned banking and fintech investors and executives who recapitalized the bank in May 2021 to help today’s business visionaries and dreamers succeed.

-

our next offering

empowers your growthWe built the framework for you to extend our simplified banking to your customers via an easy-to-implement, easy-to-sell, embedded banking solution.

-

the future vision is a

connected, compliant, ecosystemThrough meticulously selected partnerships, we will utilize our technology platform and charter to empower other banks, credit unions, and fintechs to integrate financial solutions into their customer experience, without the hassle of building them.

team testimonials

At Thread Bank, we believe in the power of cross-functional collaboration, where every team member’s unique perspective contributes to delivering exceptional results.

Create unique customer experiences with our embedded banking capabilitie

Establish merchant accounts and accept payments

Provide access to commercial and consumer loans on your platform

Want to

learn more

team values

ethical

committed to ethics and compliance

agile

adaptable and agile in a changing landscape

dependable

consistently delivering high value products and services

Experience unparalleled security and regulatory peace of mind. Our embedded banking deposit platform prioritizes compliance at every step, ensuring the safe and secure handling of your funds.

connect with us

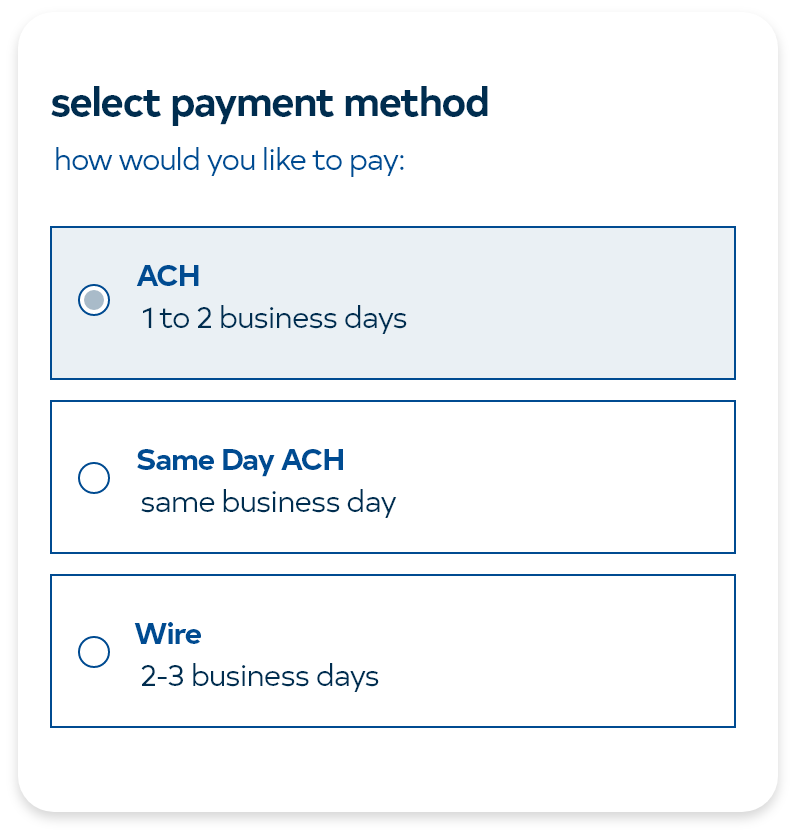

Simplify your payment acceptance and unlock new revenue streams. Our merchant acquiring platform Threaded Payments provides access to a vast network of payment rails, allowing you to seamlessly accept payments from a wide range of sources.

connect with usfeatures

PAYMENTS WITHOUT BARRIERS

a vast network of payment rails means unhindered interactions

CONNECT ANYWHERE WITH

millions of payments processed every month, managed seamlessly

CONNECT ANYWHERE WITH 2

millions of payments processed every month, managed seamlessly

getting started

See for yourself. Explore our comprehensive API documentation and discover how effortlessly you can integrate secure financial features into your platform.